I discovered compensation in the products said inside story, however the opinions is the author’s very own. Find out about how exactly we make money and all of our editorial formula. Use the vendor or fee mediator details while the found inside the verification text message otherwise on the cellular phone statement. Resellers otherwise fee intermediaries has ten days to respond to your query, thus delight let them have time for you resolve they.

Paying together with your Android unit | examine this site

You could include loyalty program cards to Samsung Shell out to conveniently accrue perks. Financial features provided by People Government Deals Bank, Associate FDIC. Adam Luehrs try an author throughout the day and you will a good voracious reader at night.

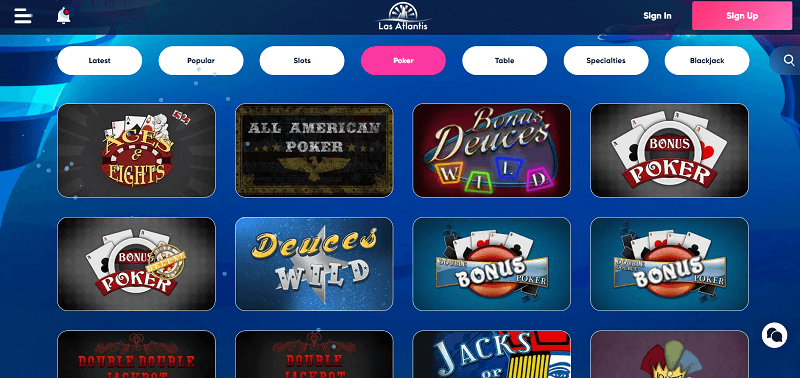

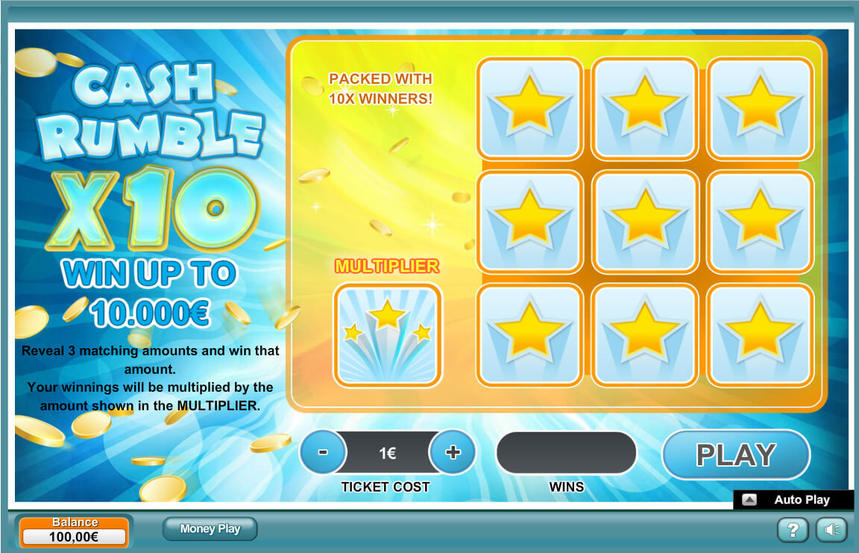

Discover the Most popular Gambling enterprise Destinations away from 2024

Here i’ve appeared a few drawbacks of doing so when wagering that have playing web sites you to undertake cellular phone statement. Gamblers should always keep in mind that there are various costs to possess mobile phone statement gaming and this are very different greatly away from service to help you service. Certain sites usually charge both for a deposit as well as an excellent detachment, which means when you are investing thru cellular telephone statement is fantastic delaying the wager, it can be slightly pricey. Explore common sense, but not, when creating a cost otherwise animated money. Make sure you’re also by using the proper method for the new percentage.

A bill shell out provider may be integrated included in an excellent examining account’s have. The new Wells Fargo Autograph℠ Card is a great zero annual commission cards that provides 3x issues on the 6 some other added bonus classes. Sms micropayment occurs when you purchase something of a vendor by sending one or more messages from your mobile cell phone. The retailer otherwise payment seller following will provide you with a good 5-finger number.

You now have completed tying your money to help you WeChat Pay and are today happy to create completely safe on line purchases. When you have a wireless account, you could potentially check it out to enroll in the TXT-2-Shell out making use of your tablet otherwise pc. This can be a free of charge-of-costs solution you to messages your your own cordless balance half a dozen months before it is due. Once you have this specific service set up, you might spend your bill with your selected percentage means just by the responding to the words message. You could choose the commission agenda as well as the matter you want to spend. And manage to establish one-time otherwise recurring payments.

Don’t worry if the bank or credit connection doesn’t give Zelle but really – you could potentially down load and make use of the brand new Zelle app up to they are doing. We have along with remaining track of people can cost you a part of the brand new greatest cellular payment apps. Earliest relaxed transactions only need you to definitely provides a straightforward-but-effective software, but if you are looking for a lot more abilities, the newest paid-to possess options might possibly be well worth a glimpse. We now have seemed the significance for money aspect of people incorporated right here.

A fees means can also be’t end up being it’s an excellent except if it’s got a great customer service party examine this site sat on the subs bench so you can care for people things you’re having. I always submit a few enquiries to get a be based on how friendly and you may better-informed for each support party is. Everything you need to do in order to utilize this provider are discover Payforit when you go to put currency.

For those who wear’t get cellular phone with you nevertheless still need to pay their expenses, you can do it on the web using your computer or other tool. On the web betting has expanded the number of available options and you will sportsbooks have chance, contours, and from the games. Chances easily alter based on what is going on on the video game and you will bettors have to make small conclusion.

Check out the My Observe case and you can faucet to the Handbag & Apple Shell out alternative. This can offer the wearable the same strength since your genuine card, so you’ll be able to shell out together with your smartwatch even if their iphone 3gs isn’t nearby. Like with Fruit Spend and you will Google Spend, you can use Samsung Spend on your own Universe mobile phone otherwise watch everywhere you see the newest contactless percentage sign, through NFC. Samsung Spend indeed happens then even when, and have supports the newest old magnetized stripe terminals for which you perform normally swipe a credit.

The payee determines the time their costs detail is actually available. How long their bill outline can be acquired selections from a month so you can 6 months. If you do not discover very first costs electronically, you ought to continue to pay one debts you can get through the send. Sometimes you’ll initiate getting electronic bills once you get see that the brand new activation request was successful.

You could potentially spend together with your bank account, debit or charge card or, in a number of components, an atm cards or currency market membership. This really is a great solution if you are on the go otherwise alongside your own statement deadline, since your percentage would be entered regarding the CenturyLink systems to the an identical date. Register back at my CenturyLink to get into their bills, spend the costs, create AutoPay, register for paperless charging you, and save your commission information to have coming you to-time costs. You might pay that have credit otherwise debit cards, otherwise bank account within my CenturyLink.

The risks associated with the percentage means are similar to the individuals your get which have on line statement shell out, whilst you have less power over the new payment day with ACH debit payments. While you are rare, payees will get happen to capture excessive or remove finance in the an excellent bad go out (should your account is actually empty, such as), leading to overdraft fees. Let’s consider simple tips to pay your own credit card, when you should shell out their mastercard expenses as well as how you can choose a knowledgeable bank card payment choices for the much time-label economic requirements. Shell out with your bank account for no fee or make use of your debit otherwise charge card to own a good $2.65 benefits percentage.

Excite be sure to investigate payee’s conditions and terms cautiously whenever available. Both signing up to discover an on-line costs means that your papers expenses was deterred, but this needs to be stated in the new payee’s fine print. After you trigger eBills, you might love to shell out you to eBill yourself otherwise install automated payments. Electronic expenses (eBills) try on the web models of paper bills you will get, take a look at, and you will shell out because of Expenses Pay. Although it may look some other, all advice from your papers bill are shown on line, and the regularity of the statement remains the same.

These are our picks for the best credit cards for home-based take a trip. You’ll find for every cards has its own unique number of advantages. You are wanting to know if the credit cards’s cellular telephone coverage is definitely worth making use of. That is especially when versus a service provider’s optional insurance rates. In case your cellular telephone try stolen or broken, you’ll must file a declare in this two months of your event. To prevent claim denial, you’ll must also give all necessary files on the cellular telephone, incident, etc. within this ninety days.